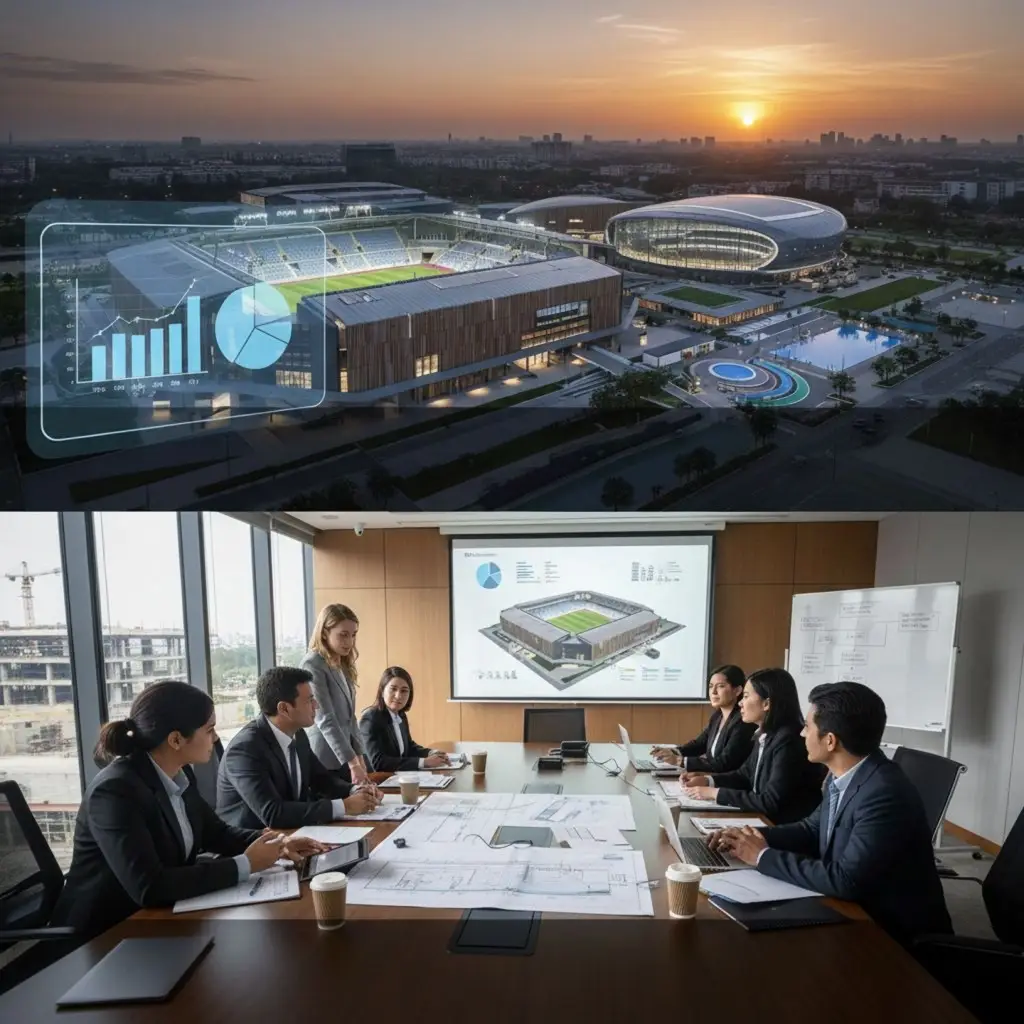

DPR & Financial Feasibility Advisory for Sports Infrastructure

We help owners determine whether a sports project is financially viable, bankable, and sustainable—before capital is committed.

What We Do

A DPR is not a document exercise—it is a decision-making tool. We prepare owner-side DPRs and financial feasibility studies that test whether a sports project should exist, at what scale, and under what financial assumptions.

Our role is to give owners clarity before commitment, not justification after decisions are already made.

- Decision-grade inputs before capital commitment

- Independent, owner side- evaluation

- Reduced financial and delivery risk

Scope of DPR Advisory

-

Project concept validation & scope definition

-

Site and land-use assessment

-

Capacity planning & sport mix optimisation

-

Capital cost estimation (CAPEX benchmarking)

-

Phasing strategy and development roadmap

-

Risk identification and mitigation framework

Financial Feasibility & Commercial Validity

Market & Demand Assessment

How can we help you?

Contact us at the Consulting business inquiry online.

Wat Do We Do

- Revenue potential & utilization modelling

- Operating cost assessment (OPEX)

- Cash flow projections and breakeven analysis

- Sensitivity and downside risk testing

- Funding structure and investment readiness

- Go / No-Go recommendations

Wat Do We Not Do

- EPC contracting

- Construction execution

- Vendor or contractor appointment

- Turnkey delivery

Olympiados remains conflict-free by operating strictly as an advisory firm and does not undertake EPC or construction works.

OLYMPIADOS

Advisory Philosophy

Who This Advisory is For

Typical Outcomes

- Private developers and landowners

- Institutional investors and funds

- Government and public authorities

- Sports bodies, federations, and trusts

- Family offices evaluating long-term sports assets

- Clear viability verdict before capital deployment

- Bankable DPR aligned with funding and approvals

- Realistic cost and revenue expectations

- Reduced execution and operational risk

- Stronger position during downstream delivery

How This Fits within Our Advisory Services

- This advisory often precedes Delivery Governance (Owner-side PMC) to protect owner interests during execution.

- DPR inputs are aligned with Standards & Performance Advisory (OPIS) to ensure design and performance benchmarks are achievable.

- Projects requiring approvals and compliance progress into Certification Readiness & Liaison.

- Financial outputs integrate directly with broader strategic feasibility advisory for long-term decision-making.